Islamic Financial Planning.

By Nurin Hamid – IFP

Islamic Financial Planning

The misconception that financial planning is solely for finance professionals or experts. However, this assumption does not accurately represent the reality of the situation. Financial planning is a structured approach aimed at achieving clear and realistic goals, designed to serve the retail segment of the financial market by developing strategies that effectively guide individuals toward their financial objectives.

In current digital era, the importance of financial planning extends beyond the above, it includes raising awareness of fraud and scam prevention. These issues have become increasingly sophisticated and by integrating knowledge in financial planning, it allows individuals to protect their assets and secure their decisions.

Islamic Financial Planning incorporates essential elements that align with ethical principles and Shariah compliance, while maintaining a structure nature of traditional financial planning. This discipline provides guidance on the responsible management of income, wealth and estate distribution, all in accordance with the values of equity, transparency, and the welfare of the community.

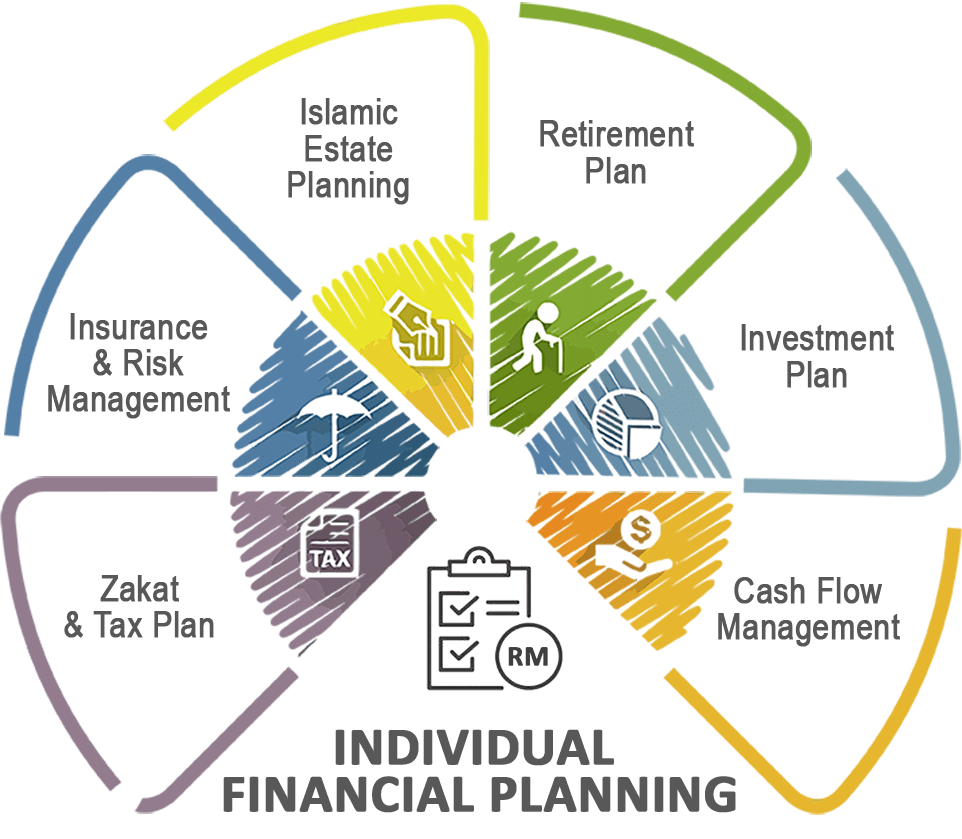

Core Element in Financial Planning

Islamic Financial Planning also comprises of SIX (and some may categorised FIVE elements which combine Investment & retirement plan as one element) main elements which is similar to the standard Financial Planning. However, this website will focus on Islamic Financial Plan.

Islamic Estate Planning - The final planning phase encourages us to distribute our assets for our beneficiaries accordingly though Will, Hibah, Waqaf and Living trust. It wil avoid or minimize any hassle among the beneficiaries later.

Takaful & Risk Management - Risk management is to mitigate and identify risks through effective financial and takaful management. This method is one of the most important area to make sure the sustainability of income for our family in the event of unforeseen circumstances such as pre-mature death, disability or critical illnesses.

Zakat & Tax Plan - Managing our responsibilities toward taxes for the country and fulfilling our obligation for Zakat is somewhat a must. Nevertheless, we should be doing it properly and systematically.

Retirement Plan - Planning for our retirement years strategically during our working years to achieve financial independence when we retire is utmost important because our future is uncertain. Usually at retirement starts at 55 years and above.

Investment Plan - Investment plan is method to allocate our assets in different financial instruments which focus to meet our financial goals and grow our wealth. A systematic investment portfolio is also to accumulate and optimise our wealth.

Networth & Cash Flow Management - Understand our Networth value helps us to manage our income, expenses and budget accordingly. By understanding our balance sheet, manage our asset and liabilities we will be able to meet our future financial goals.

Nurin Hamid

Nurin Hamid has over 25 years of experience in banking and finance, with a strong focus on Islamic Financial Planning for the past 15 years. She graduated with a BSc (Hons) in Actuarial Science and is a certified Islamic Financial Planner (IFP) certificate. She also holds Capital Market Services Representative’s Licence (CMSRL), regulated by Securities Commission Malaysia, as a Financial Planner Representative (FPR).

In 2024, she was appointed as a panel member for Malaysia’s National Occupational Skills Standards (NOSS) in financial planning for the development of all competency levels. This qualifies her to obtain Malaysia Advanced Skills Diploma from the Department of Skills Development (MoHR Malaysia) for her commitment to the industry.

Nurin Hamid

Founder – Mind Tech Training & Resources

For Consultation and Advisory services, please contact us.

JOIN OUT TEAM & road to Financial Freedom

Financial Planner Representative (FPR)

FPR with a CMSRL is certified Financial Planner who can provides comprehensive financial advisory service and qualified to offer investment-related services and products, contributing to ethical financial decision-making. This profession offers tailored financial strategies to help clients achieve financial security while adhering to regulatory frameworks.

Area to be specialised:

Comprehensive Financial Planning

Provides and assists clients with holistic financial planning services by evaluating their current financial status, developing personalized strategies and creating justifiable financial plans. This process includes continuous monitoring and adjustments to optimize financial health, ensuring resilience and stability in both favorable and challenging economic conditions.

Takaful and Risk Management Advisory

Guides and assists clients in managing financial risks by addressing potential liabilities, lifestyle protection, healthcare coverage, and investment security through Takaful plans. As a Shariah-compliant solution, Takaful offers a collaborative approach to risk mitigation, ensuring ethical and contingency-based financial safeguards.

Investment Portfolio Plan

Provides and assists clients with comprehensive support in managing their investment portfolios, including private mandate portfolios across global, Asia-Pacific, and local markets. Services incorporate the management of equities, unit trusts, and private retirement schemes (PRS). Investment strategies are tailored based on assessment of clients’ financial circumstances, risk tolerance, and investment objectives, aiming to maximize portfolio performance.

Islamic Estate Plan Specialist

Provides and offers expertise in managing Islamic estate plans, covering Wasiat (Islamic wills), Hibah (gifts), Waqaf (endowments), matrimonial assets, and living trusts to ensure effective asset distribution and debt resolution in case of unforeseen circumstances. While Muslim estate distribution follows Faraid law, requires proactive action for implementation. This role ensures the necessary measures are taken to fulfil obligations and alignment with Islamic principles.

Other Professions

Potential Rewards

UNLIMITED INCOME & STABLE RETIREMENT PLAN

You are able to perform unlimited income and develop your own stable retirement plan for your future and beneficiaries.

BONUSES & OVERSEAS FREE TRIPS

There are more than one time yearly bonus such as persistency bonus and incentive bonus. Consultants are also eligible for free overseas Conventions base on performance.

DEVELOP YOUR OWN LEGACY THAT CAN BE INHERITED

Consultants who become leaders are able to build thier own business legacy and duplicate their achievements to their team.

AWARDS & RECOGNITIONS

The Organisation / industry will recognise consultants or leaders base on their outstanding achievements and performances.

Workshop & Training Program

FINANCIAL PROGRAM

HUMAN RESOURCE PROGRAM

OTHER TRAINING PROGRAM

Latest Articles

New Year 5 Dimensions Resolution

Year 2021 is knocking our doors and this new year I would say is our ‘rectification’ year. Unforgettable year 2020 was a challenging year for everyone around the globe >...

BELANJAWAN 2021 – PELUANG YANG ADA

Topik belanjawan ini masih lagi menjadi perbualan yang hangat semasa naskah ini ditulis. Pada hakikatnya, pada tahun ini 2020, hari hari yang lalui agak sukar bagi kebanyakan rakyat marhaen dan >...

BUDGET 2021 – A REVIEW

The Malaysia Budget 2021 topic is still becoming one of the hot topics among Malaysia. “No one is left behind”. Our Prime Minister’s statement greatly comforted us as Covid-19 pandemic >...

Malaysian 2021 Budget – Map our Strategy

Malaysia 2021 Budget is trending in the country. The past months have not been easy. In fact, we are in the months of living cautiously. The normal is abnormal and >...

Please Contact Us

www.nurinhamid.com | Copywright 2024